As a career, trading is unlike most professions. We sit and observe for the majority of the time, and then act when we sense the appropriate time. To observers, this can often be interpreted as ‘doing nothing’. Where a doctor goes to the hospital and works 15 hour shifts, you sit in your pyjamas at home waiting for Solana to hit your entry price. Funnily enough if you make enough right decisions the doctor ends up wondering why they’re earning less than a guy who stays at home all day doing nothing.

However what happens when you start making mistakes? The common reaction would be to do more.

‘I didn’t work hard enough which is why I lost money so let me compensate by working harder’

Subconsciously or not, I find that most times my brain reverts to this mindset, especially in combination with the net worth anchor you had at the highs.

‘I’m now down 10% from my highs I achieved yesterday, so let me trade more to get back to all time highs’

However this fails to take into account the real reason for the loss and results in an unbalanced mental state that is likely to produce subpar results. In poker, we call this tilt.

Everyone goes through tilt at some point in their trading careers. After all, we are only human. However managing this tilt and limiting the damage it can inflict on your portfolio is something very few people talk about.

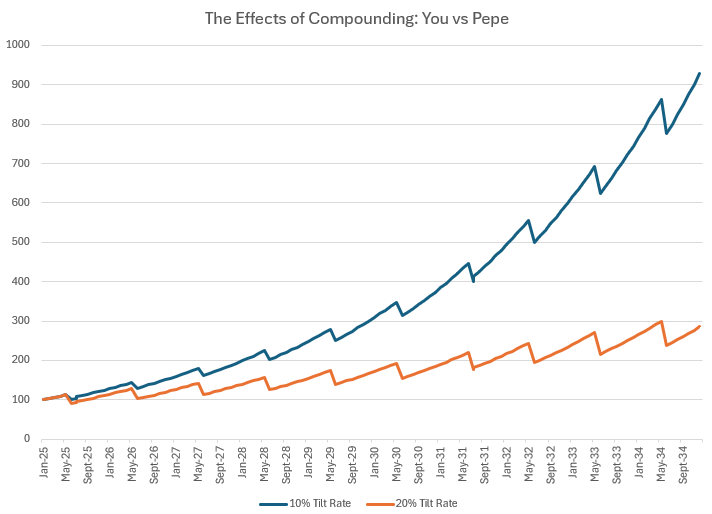

Let us do some simple maths - assume that you are currently a profitable trader, able to generate 3% a month on infinite scale. However, once a year you will have a bad month and end up losing significantly more than a normal winning month. For simplicity let’s assume you drawdown 10% during these ‘tilt’ months. Over time, you’ll still do pretty well, as you’re able to cap your losses to a number that is manageable.

Now take your imaginary friend, Pepe. Pepe uses the same winning formula you use, but is a tad bit more emotional than you. During his ‘tilt’ months, he takes longer to recover and inflicts more damage on his portfolio because he is unable to get out of his mental rut. Pepe draws down 20% during these months.

1st Year Return: You - 28% | Pepe - 14 %

3rd Year Return: You - 93% | Pepe - 36%

10th Year Return: You - 828% | Pepe - 186%

Over time through compounding, you’re able to pull away from Pepe on a relative basis because you lose less than him in your tilt months.

Although hypothetical, I find this example useful because most trenchers or seasoned crypto natives (which is the majority of the audience) are able to generate some sort of sustainable return during bull markets. However, risk management and loss mitigation is severely underexplored which leads to many taking on various forms of inner Pepe during bear markets. From my experience, I’ve found that although I’m not a great bull market trader (I’m pretty trash at chasing momentum), I risk-manage losses reasonably. This has led to smoother return curves that are less stressful to deal with and ultimately increases the sustainability (and joy!) of trading.

Stopping The Tilt

The first step in reducing tilt is to of course be aware of it’s existence. Having awareness of your mental state will allow you to determine whether you are on your A game, where you’re in a flow state in sync with markets, or whether you’re in your F state, where no matter what you do you can’t do a thing right.

I personally have suffered two different types of tilt, with varying intensities.

Type 1: Mild Tilt

I’ve found that once I’ve suffered three consecutive losses in a row, my mental state starts deteriorating and the quality of my consequent decision making suffers. Emotions experienced often include annoyance at myself for making sloppy mistakes but don’t typically lead to anger, frustration or sadness.

Whenever this happens, I employ a hard reset of 2-3 days where I would close all positions and not trade unless extenuating circumstances present themselves. In this time period you can pursue anything that puts your mind at ease (I game to destress but you do whatever works for you).

When returning, I tend to size down on my trades (usually 50% of normal size) and build back to normal after obtaining a streak of good results.

Type 2: Moderate Tilt

This comes much more infrequently for me but would be a result of sustained losses despite my attempts to recover from Type 1 Tilt. Stronger feelings of frustration till a point of helplessness are common and it seems like no matter what kind of setup you take, the L is inevitable. For example, May of this year was probably my worst tilt streak since starting Tangent and I took about 6 weeks to identify and fully reset from this tilt.

The solution here would be to extend the trading ban to 7-14 days, and come to terms with the new portfolio value I have (often times this would be after a couple of nasty losses). During this period the key is to be at peace with opportunities forgone both during and after the trading ban and a full emotional reset where you no longer feel the drive to make back what you have lost. Going on a holiday, or simply not staring at charts can be options to achieve that mental unplug.

When returning, I size down my trades to 25% of normal size and strictly only trade according to my strengths. No other setup is taken and I prioritize collecting a series of wins, no matter how small they are. This is more challenging than one would think, because strict adherence to this ruleset is key and this may result in PNL forgone (which is why we need to make peace with it earlier during the ban!)

Closing Thoughts

Dealing with drawdowns is an unpleasant business, often involving acceptance of a lower portfolio value and reflections on what went wrong / what needs to be addressed. However it is part and parcel of what I consider to be sound process. Sometimes, less is more and this is especially so for trading.

Good luck out there and make sure your inner Pepes don’t rear their ugly heads too frequently.

Glad to see you're still sharing you Pigeon knowledge.

I as fellow pigeon share many of your ideas but this has helped me with some of the anti-tilt implementation

have been following your tweets -> tg posts -> this blog for quite some time now. Your thesis has been widely correct even looking back (ena for example with all the stablecoin hype the past few months). Truly grateful to have folks like you around.